The Holy Grail: Direct Deposit Switching

The action of having your paycheck directly deposited into a bank has been called the holy grail for banks because they make money largely under an assets under management (AUM) model, where they monetize your deposits and receive interchange fees off transactions. In fact, this product is critical for banks because it is often the conversion point from an unprofitable to profitable customer. And once set up, direct deposits create sticky customers with recurring revenue and high barriers to switching. It’s no wonder that banks incentivize consumers by waiving minimum balances and providing generous bonuses.

While direct deposits are a win for banks, what’s in it for the consumer to switch? Lately, a lot! With the rise of neobanks like Chime and Green Dot offering a mobile-first product with fewer-to-no fees, higher yields on savings, protection against onerous overdraft fees, and early cash advancement on wages, there’s a lot to like. Unfortunately, the act of switching direct deposits is manual and painful.

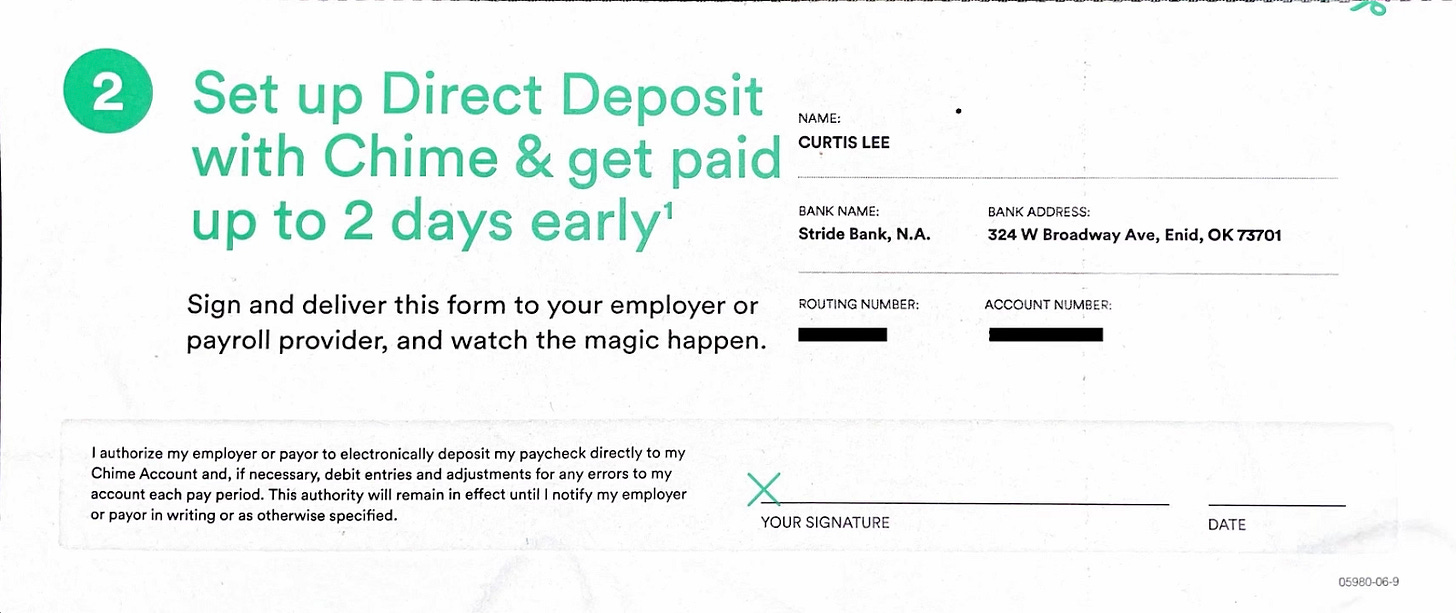

While competition in banking has driven an uptick in technological innovation and product quality, direct deposit switching has remained largely the same as when it was launched (back about 50 years ago). Switching often means filling out physical paperwork that must be submitted via snail mail, is plagued by long wait times, and can require submitting multiple requests to be successful. In some cases, employees must manually submit through their HR department -- an activity that often gets deprioritized. All in all, it can be a months-long tedious process, a key reason why consumers are hesitant to move their funds and tend to stay with the same bank for an average of 16 years. Exhibit A: the form Chime sent me when I opened up an account.

Exhibit A: Chime direct deposit form

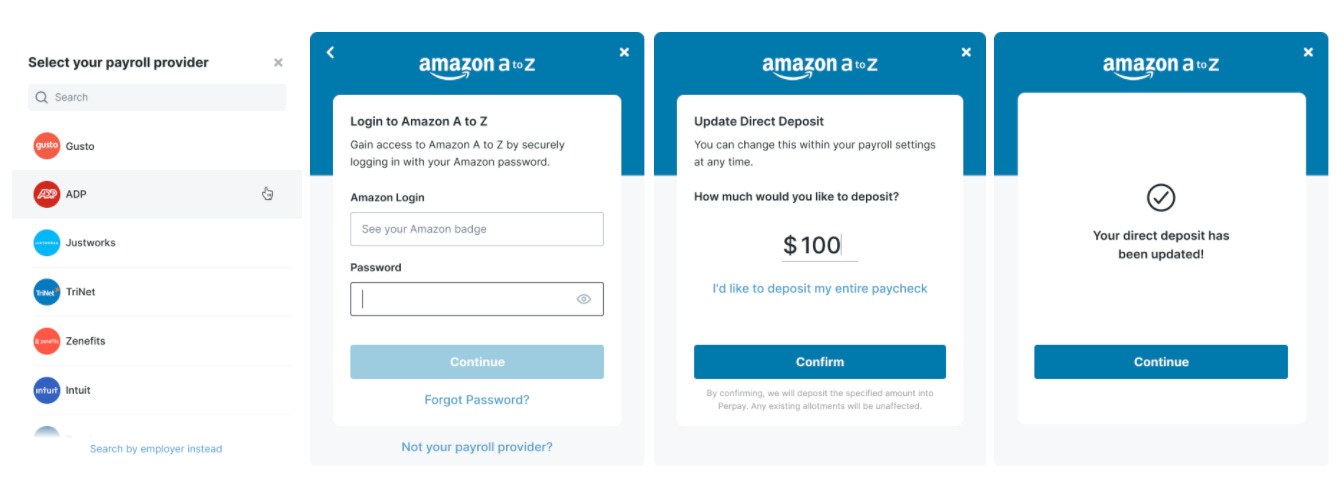

Fortunately, there is a better way. Through Pinwheel’s Direct Deposit Switching (DDS) product, we can programmatically switch your deposit to a new bank of your choice via our API. It’s fast, easy, safe, and efficient for consumers to automatically switch their direct deposit institution in just a few clicks. Simply search for your employer or payroll provider, specify the amount to be deposited, log in to your account, and request to switch (see Exhibit B). Our banking customers require a simple integration with our API to enable these capabilities in their app.

Exhibit B: Pinwheel DDS user flow

Not only does it rapidly expand a bank’s profitable customer base, but it also gives consumers visibility and control over the allocation of their deposits. Additionally, companies no longer have to deal with the burden of employee requests related to switching. It’s a rare win-win-win. If you’re interested in learning more, check us out at Pinwheel or email me at curtis at getpinwheel dot com. And if not, still enjoy this great song by Jay-Z + JT with this blog’s namesake.